Market Minute: Dollar tumbles as investors exit U.S. assets

The U.S. government’s effort to overturn the global trading system has stimulated an exit from U.S.-denominated assets, causing sustained volatility across asset classes.

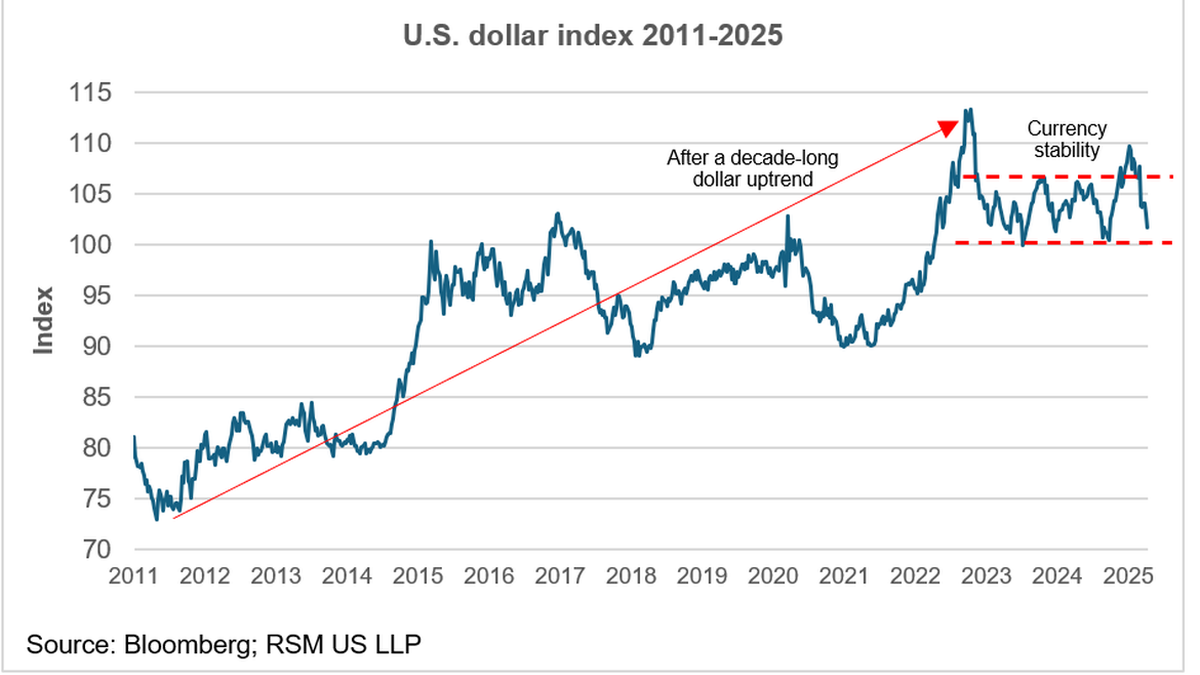

Foremost among those is the decline in the U.S. dollar by 1.87% on Thursday, which is the third consecutive day of losses for the greenback.

A loss of credibility and confidence in the policy to disrupt patterns of trade has spread from domestic financial investors to global fiscal and monetary authorities that appear to be selling Treasury securities and dollars.

A tumultuous rollout of the new trading regime has undermined the confidence of safe-haven American financial assets as investors suddenly face a three-month period of uncertainty in which $1.1 trillion in trade taxes may or may not be imposed on goods entering the U.S.

This unusual convergence in asset pricing volatility in the S&P 500 is similar to what was experienced during the 2008 financial crisis.

Since April 2, the S&P 500 has fallen by 7.1% and the dollar has declined by 7.5% against the Swiss franc—a safe haven in times of tumult. And the global benchmark 10-year US Treasury has sold off, with a 7.1% increase in yield from 4.13% to 4.42%.

The Chicago Board of Options Volatility Index, a measure of expected volatility in the S&P 500, has increased by 89.31% over that same time.

Financial chaos has its cost.

The cost of that turmoil its being played out in the depreciation of assets across the stock, bond and currency markets.

This article was written by Joseph Brusuelas and originally appeared on 2025-04-11. Reprinted with permission from RSM US LLP.

© 2024 RSM US LLP. All rights reserved. https://realeconomy.rsmus.com/market-minute-dollar-tumbles-as-investors-exit-u-s-assets/

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.