Estate planning Q&A: Spousal Lifetime Access Trusts explained

A Spousal Lifetime Access Trust (SLAT) can be a valuable tool to transfer wealth to future generations while helping to ensure your spouse’s financial security.

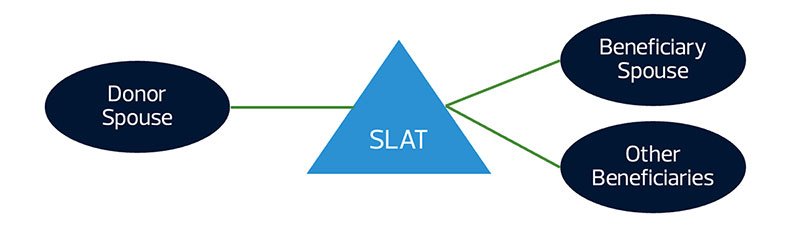

What is a SLAT?

A SLAT is an irrevocable trust that can provide significant flexibility for married couples. One spouse creates and funds a trust primarily for the benefit of the other spouse. The spouse that is the beneficiary of the SLAT can receive distributions from the trust. Thus, if necessary, your spouse is able to use funds from the trust to maintain their standard of living even though the trust assets have been removed from your estate. SLATs most often terminate at the death of the beneficiary spouse, at which point the trust assets pass to the other SLAT beneficiaries (typically a younger generation), either outright or in trust.

What are the requirements for establishing a SLAT?

- The donor spouse must gift assets that are their sole property (not property owned by the spouses jointly).

- If you reside in a community property state (AZ, CA, ID, LA, NV, NM, TX, WA, and WI), you may first need to convert your community property into separate property before making gifts to a SLAT.

- If two SLATs are created (one for each spouse), they cannot be identical to each other. If they are identical, the IRS can apply the” reciprocal trust doctrine,” which can undo the benefits of your planning.

- The donor spouse cannot directly retain any rights to the assets gifted.

- The trust must be irrevocable.

What are the benefits of setting up a SLAT?

- Your spouse can maintain access to the assets owned by the SLAT if they need additional cash flow.

- Any asset appreciation after the initial gift occurs outside of your estate.

- You are responsible for paying income tax on any income generated by the SLAT. Paying income taxes on behalf of the SLAT is not considered an additional gift to the SLAT. The SLAT is able to grow without being reduced by the payment of income taxes, leaving more to pass to your beneficiaries.

- Assets placed in a properly-established SLAT are generally protected from creditors of the beneficiary spouse.

- Generally, SLATs can hold S corporation shares.

What are the potential downsides to setting up a SLAT?

- It is not ideal for the beneficiary spouse to withdraw funds from the SLAT unless they are truly needed. SLAT distributions to the beneficiary spouse bring assets back into their estate and reduce the trust assets that can grow estate tax free for the ultimate beneficiaries.

- If the beneficiary spouse dies first, the donor spouse loses their indirect access to the trust assets through the distributions to the beneficiary spouse.

- In the event of a divorce, you may still be responsible for paying the income tax on a trust for the benefit of a now ex-spouse.

- When your beneficiaries inherit the assets, they inherit the original tax basis you had. This might not be ideal for assets with low basis, meaning the beneficiaries could owe more capital gains tax when they eventually sell. However, many SLAT documents allow the donor spouse to remove a low basis asset and replace it with a high basis asset if those assets have the same value.

Is a SLAT right for you?

SLATs can be a flexible way to transfer wealth to future generations at current values while allowing your spouse to have access to that same wealth. If you want to take advantage of the current estate tax exemption amounts but aren’t quite ready to give up complete access to your assets, a SLAT could be the right strategy for you. By understanding the requirements, advantages, and potential downsides, you can make an informed decision about whether a SLAT is right for your estate planning needs. As always, consult with your tax advisor to tailor a strategy that best suits your situation and goals.

This article was written by Scott Filmore, Ashley Pye, Amber Waldman and originally appeared on 2024-07-15. Reprinted with permission from RSM US LLP.

© 2024 RSM US LLP. All rights reserved. https://rsmus.com/insights/services/business-tax/estate-planning-q-and-a-spousal-lifetime-access-trusts-explained.html

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.

The information contained herein is general in nature and based on authorities that are subject to change. RSM US LLP guarantees neither the accuracy nor completeness of any information and is not responsible for any errors or omissions, or for results obtained by others as a result of reliance upon such information. RSM US LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect information contained herein. This publication does not, and is not intended to, provide legal, tax or accounting advice, and readers should consult their tax advisors concerning the application of tax laws to their particular situations. This analysis is not tax advice and is not intended or written to be used, and cannot be used, for purposes of avoiding tax penalties that may be imposed on any taxpayer.